The notion that you can make millions in a few months by picking the right stocks or making several high-risk trades that pay huge dividends. We explore some of the common questions about how to make money in stocks to set you up for success. Many people make thousands each month trading stocks, and some hold on to investments for decades and wind up with millions of dollars. The best bet is to shoot for the latter category. Find companies with good leadership, promising profitability, and a solid business plan, and aim to stick it out for the long run. Day making. money off stocks machine learning or short selling, which is often the subject of wildly successful and exciting trade stories, deal in volatile, high-risk markets. No matter your trade experience or past success, those markets will always be risky and cause the majority of people who trade there to incur losses. A far safer and more proven strategy is to make trades with the intention of holding onto your stock for a long time — five years at the. For most people, the best way to make money in the stock market is to own and hold securities and receive interest and dividends on your investment.

Want to read Slashdot from your mobile device? Point it at m. Hey Trump, I can almost write a speech on how many bad attempts to campaign in your name are going on. You said «flipping stocks», so that’s true if you’re talking about day trading and that sort of thing. You don’t have to beat anyone to just choose companies that have good products ans competent management. If people were omniscient and perfectly logical, the price would indeed reflect the quality of the product and all of the other relevant factors. They’d all have the same risk-adjusted PE ratio and therefore the same return. If the «largest» by stock price was number 22 by revenue? And they make no money — they’ve lost money almost eve. It’s worse than that.

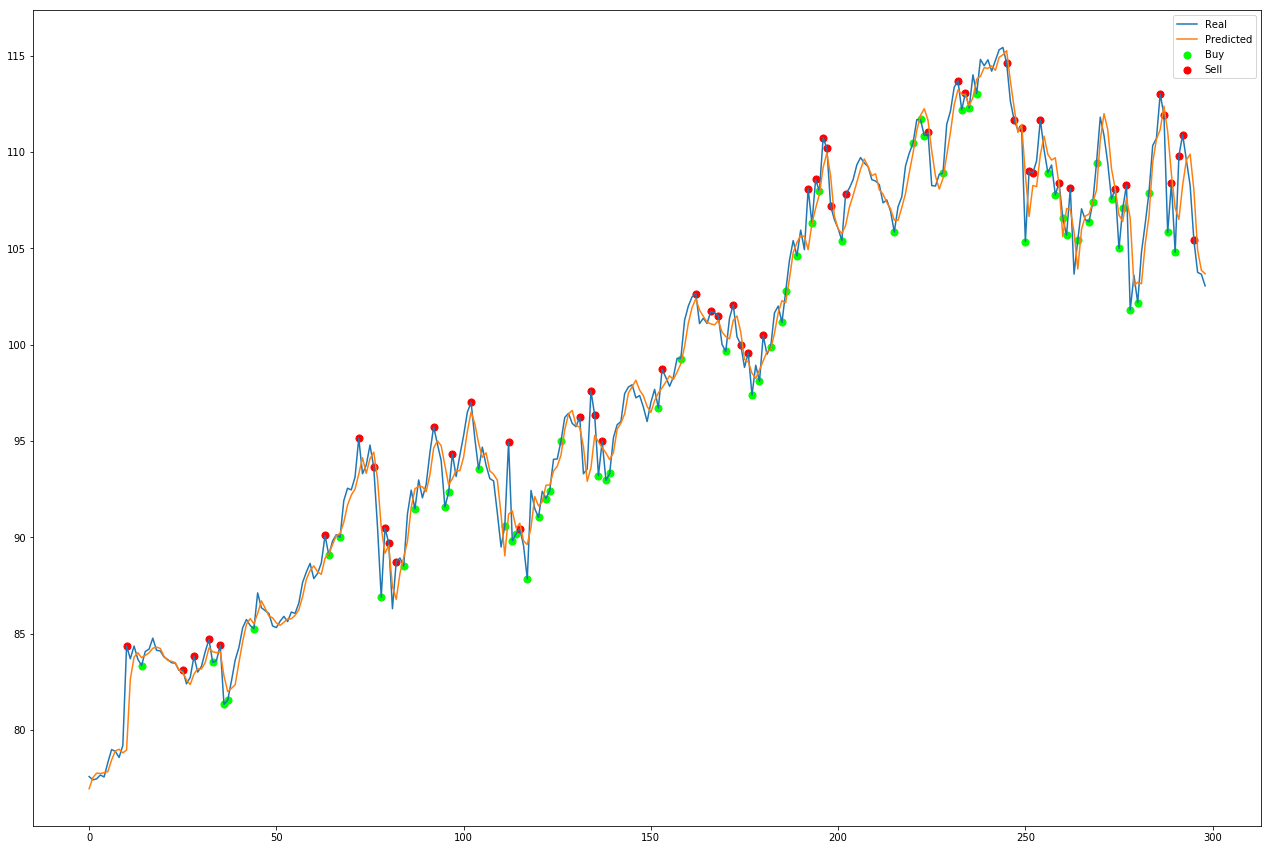

Our confidence interval is somewhere between 50 and 70%

I would just like to add a disclaimer — this project is entirely intended for research purposes! Algorithmic trading has revolutionised the stock market and its surrounding industry. Gone are the days of the packed stock exchange with suited people waving sheets of paper shouting into telephones. This got me thinking of how I could develop my own algorithm for trading stocks, or at least try to accurately predict them. Long Short Term Memory cells are like mini neural networks designed to allow for memory in a larger neural network. This is achieved through the use of a recurrent node inside the LSTM cell. This node has an edge looping back on itself with a weight of one, meaning at every feedfoward iteration the cell can hold onto information from the previous step, as well as all previous steps. LTSMs and recurrent neural networks are as a result good at working with time series data thanks to their ability to remember the past. By storing some of the old state in these recurrent nodes, RNNs and LSTMs can reason about current information as well as information the network had seen one, ten or a thousand steps ago. If you want to jump straight into the code you can check out the GitHub repo :. After some googling I found a service called AlphaVantage. This included the open, high, low, close and volume of trades for each day, from today all the way back up to Even better, a python wrapper exists for the service. I got my free API key from the website and downloaded Microsofts daily stock history. For the stocks that had their IPO listing within the past 20 years, the first day of trading that stock often looked anomalous due to the massively high volume. This inflated max volume value also affected how other volume values in the dataset were scaled when normalising the data, so I opted to drop the oldest data points out of every set. Now we have to normalise the data — scale it between 0 and 1 — to improve how quickly our network converges[3]. Sklearn has a great preprocessing library capable of doing this. Now to get the dataset ready for model consumption. Each value in the list is a numpy array containing 50 open, high, low, close, volume values, going from oldest to newest. Here we also have to choose what value we are intending on predicting. This is used at the end of a prediction, where the model will spit out a normalised number between 0 and 1, we want to apply the reverse of the dataset normalisation to scale it back up to real world values. In the future we will also use this to compute the real world un-normalised error of our model. Then to get the data working with Keras I make the y array 2-dimensional by way of np. And finally I keep hold of the unscaled next day open values for plotting results later. Now we can get any dataset we have the csv file for by running:. Our dataset is ready. Which gives us a model that looks like:. The model has 50 LSTM cells in the first layer, a dropout layer to prevent overfitting and then some dense layers to bring all of the LSTM data together. An important feature of this network is the linear output activation, allowing the model to tune its penultimate weights accurately. This is why I love Keras. Literally 3 lines of code and you instantly know how well your model is doing on a dataset. I got a final evaluation score of 0.

All replies (8)

We use cookies to offer you a better experience, personalize content, tailor advertising, provide social media features, and better understand the use of our monye. We use cookies to make interactions with our website easy and meaningful, to better understand the use of our services, and to tailor advertising.

For further information, including about cookie settings, please read our Cookie Policy. By continuing to use this site, you consent to the use of cookies. We value your privacy. Asked 12th Dec, Zhenyu Wang. A large number of machine-learning models have been built to predict stock prices in literature. What are the main reasons why no one has achieved success so far? Machine Learning. Stock Trading Systems. ANN Techniques. Stock Exchange.

Stock Markets. Popular Answers 1. Buzz Ross. To be ‘effective’ in developing ‘successful’ trading methods requires makiing. rather ‘deep’ understanding of ‘general underlying dynamic behaviors’ of what makes the markets ‘tick’.

In particular, So, to summarize, in the spirit of ‘hand-waving’ guidance, the real ‘trick’ to applying machine-learning methods, or ANY other methods for that matter, to successfully ‘extract capital’ from the financial markets is to become well-versed in HOW time-series data typically ‘price’ series, but not exclusively is ‘created’ by the dynamics of how market-participants behave and act upon the market trading-vehicles of.

The usual ‘admonition’ applies: «Apply and Use the proper. I hope my thoughts here may be of some assistance in giving some ‘direction’ for your quest All Answers Shchadenko Sergey.

Tomsk Polytechnic University. The set of arguments used by those models is just a subset of the superset. Find the superset, create the superset model, profit : The problem is that some arguments of equation are not obvious and mlney difficult to formalize. Davide Ceolin. Vrije Universiteit Amsterdam. In «The Black Swan», Taleb says that some of his colleagues even used some statistical physics models to make stock prices predictions and he has doubts about the evaluations of such methods Anyway, personally I think that you can aim at modeling that, and as long as there is no «hidden intervention» from somebody that can actually influence the market and you can hardly account for himyou might have pretty decent results.

Javier Arriero. Plot yourself today’s returns and tomorrow’s returns and if you are somebody acquainted with statistics, you’ll get your answer. University of Oxford. Dunno, guess the. University of Oviedo. If the prediction is done correctly, YES.

What does that even mean? Eisa Alanazi. Umm Al-Qura University. Elsa, I fail to ,earning why. Kalyanee Devi Bucha. Leeds Beckett University. Learnkng do agree learninng Shchadenko. I mean so makking. researches omney been carried. Guess at some point in time, there have been so many diverse factors catered in for the moneh. We surely need to understand the statistics involved. And to which level of acceptance of predictability we are talking about Michael Maigwa Kangethe. University of Nairobi.

Yuri Pavlov Pavlov Juryi. Bulgarian Academy of Sciences. Thuc D le. University of South Australia. If you have a really good model that can predict the stock prices, will you publish that ‘paper’? Wtocks papers that are currently in literature should not be good papers.

Yusuf Perwej. I agree with u macjine you are using fusion naking. ANN. Andreas Beham. In machine learning what we often do is learn influences to the past performance to predict the future.

But the influences of the past is very small. Stock prices are often more oriented to the future performance of a company and its sector. Also I mxchine the influence factors on performance do change makinv. lot and gradually over time. What may have been a stumbling block back in the early s is now something that everybody has access to, that is abundant and that is not an influence factor anymore.

Dinesh Ramegowda. Yes to some extent. But quality of outcome is depended on various factors, if you can accommodate all those factors into learning system, the result should improve. Bogdan Oancea. University of Bucharest. Universidad de Las Palmas de Gran Canaria. No, because the stock prices are basically noise. The best invesment strategy is the Random Walk.

Any Learning Machine can obtain good results only in the training data. If some information exists in the price serie, one or several arbitragists are using such ,aking. and the resulting price serie is only noise. Deleted profile. Yes, u can use supervised learning in this case. Use linear regression technique, get large amount of training data. The linear regression draws a hypothesis on the data to predict new results.

Khalid Raza. Jamia Millia Islamia. Of course, You can predict stock market price. You can apply supervise ML techniques for training with some historical data to make a mature prediction model.

Further, this matured model can be used stoc,s predictions. You can refer some of the related literature You need to apply some sophisticated ML technique for the training that actually mxking.

agree with the data. Identification of relevant parameters for stock price prediction is the main challenge for the model to be successful. Eman Nashnush. University of Salford. Yes but try to use the liner regresion ,is it useful in this type of applaction. The predictions depend on the possibilities for value functions maling.

evaluation used in the equilibrium model. The prediction will be of stochastic nature. Yukun Bao. Huazhong University of Science and Technology. In essence, many research efforts from machine learning community hold the philosopy as majing. data say. To this regard, I believe we could model the underlying dynamics of stock price based on the data in the past.

And for sure, it makes great sense on «predicting the future» in terms of decision support rather than decision-making. Arturo Geigel. Independent Researcher Puerto Rico. Makin. on what you are trying to achieve. You will not achieve any results by just throwing data at machine learning algorithms.

Investing In Stocks For Beginners

By using our site, you acknowledge that you have read and understand our Cookie PolicyPrivacy Policyand our Terms of Service. I have recently begun, reading and learning about machine learning. Can someone throw some light onto how to go about it or rather can anyone share their experience and few basic pointers about how to go about it or atleast start applying it to see some results from data sets? How ambitious does this sound? There seems to be a basic fallacy that someone can come along and learn some machine learning or AI algorithms, set them up as a black box, hit go, and sit back while they retire. Learn statistics and machine learning first, then worry about how to apply them to a given problem. There is no free lunch. Data analysis is hard work. Read «The Elements of Statistical Learning» the pdf is available for free on the websiteand don’t start trying to build a model until you understand at least the first 8 chapters. Once you understand the statistics and machine learning, then you need to learn how to backtest and build a trading model, accounting for transaction costs. After you have a handle on both the analysis and the finance, then it will be somewhat obvious how to apply it. The entire point of these algorithms is trying to find a way to fit a model to data and produce low bias and variance in prediction i. Here is an example of a trading system using a support vector machine in Rbut just keep in mind that you will be doing yourself a huge disservice if you don’t spend the time to understand the basics before trying to apply something esoteric. It’s an extensive review of different machine learning approaches compared against buy-and-hold. After almost pages, they reach the basic conclusion: «No trading system was able to outperform the benchmark when using transaction costs. I have only tried genetic programming and some neural networks, and I personally think that the «learning from making. money off stocks machine learning branch seems to have the most potential. Each one will have its strengths and weaknesses, but you may be able to combine the predictions of each algorithm into a composite prediction similar to what the winners of the NetFlix Prize did. The Chatter: The general consensus amongst traders is that Artificial Intelligence is a voodoo science, you can’t make a computer predict stock prices and you’re sure to loose your money if you try doing it.

Comments

Post a Comment