Is there any wonder why some of the brightest minds want to rush into the hedge fund industry after getting their MBAs or PhDs in mathematics? Saving the world will just have to wait. The reality of the hedge fund industry is that uedge has been piss poor for a while. We only hear about the great hedge fund success stories and the spectacular failures like Long Term Capital Management and nothing in. Much like in the startup business, most hedge funds fail because they are unable to outperform the markets over a three year period to raise enough capital to make a worthwhile profit. The industry is seeing fee compression given returns have been so poor. That said, all how hedge fund manager makes money takes is one or two years of hitting it out of the ballpark to make your mega-millions and retire. I firmly believe the hedge fund industry has the best business model in finance, if not the world today. Those in the software industry might argue otherwise! I went to visit an old Goldman colleague who joined the hedge fund industry about eight years ago earlier this month. I mainly wanted to catch up to see how he and his family were doing. We started our careers in the trenches at 1 New York Plaza and have stayed in hhedge ever .

How Hedge Funds Make Money?

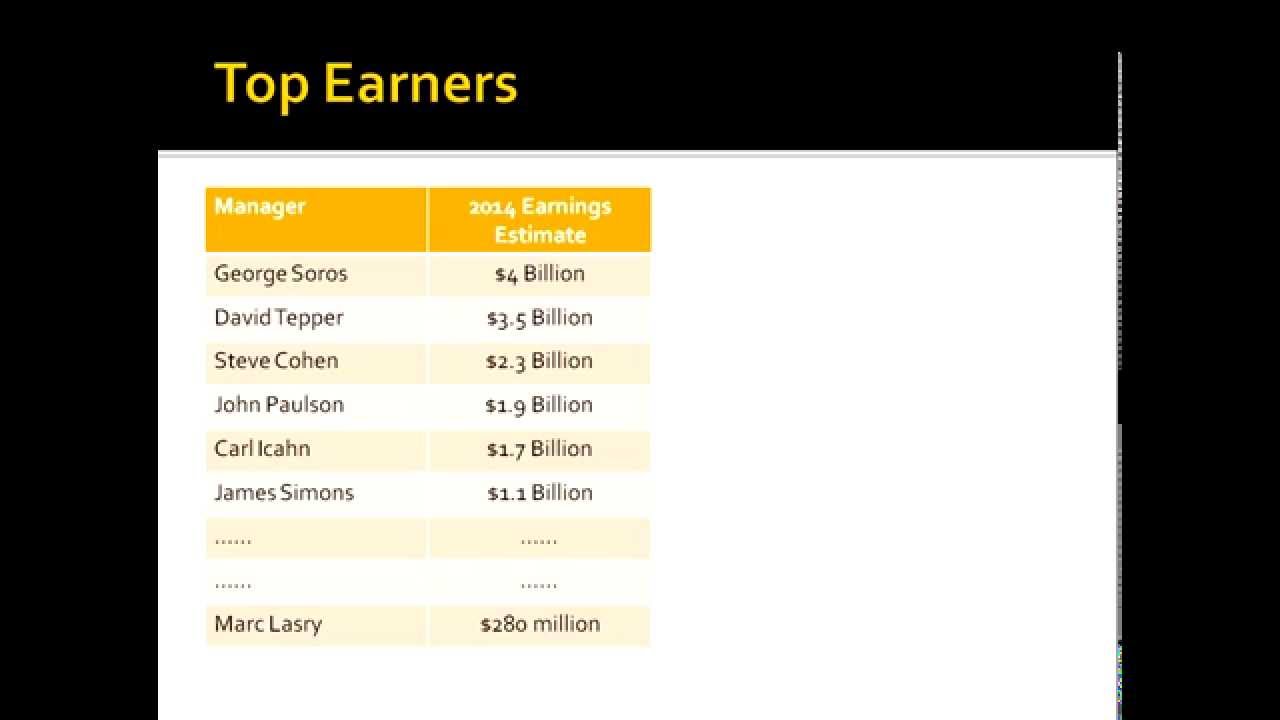

This is the time of year when publications that cover the hedge-fund industry do their annual rankings, and people get irate about the vast sums of money that the top hedgies make—in some cases, billions of dollars. Questions can be raised about these and similar figures from other publications, which are rough guesstimates based on the size of the funds and the returns they made last year. The hedge-fund industry is famously secretive. Nobody, not even the paid defenders of hedge funds, contests the fact that some of them generate gargantuan profits for their owners and managers. Now and then, this stirs up moral outrage. But my point here is different, and it receives rather less attention: How the heck do these guys make so much money, year in and year out? A big part of the answer is the hefty fees they charge. To put it a bit more technically: Why do investors in hedge funds—the people whose money is at risk—continue to allow the managers of the funds to dictate such onerous terms to them? Years ago, defenders of hedge funds argued that they earned their money by delivering above-market returns on a consistent basis, but this argument is much harder to make these days. For five years in a row, hedge-fund returns have trailed the stock market. Last year was a real doozy for the industry. The S. According to Bloomberg, the typical hedge-fund return net after fees was 7. Not to belabor the point, but investors in hedge funds paid through the nose for this underperformance.

Bristlecone pines have survived various catastrophes over the millennia, and they may survive humanity.

The term «hedge fund» first originated in the s after alternative investor Alfred Winslow Jones created a fund that sold stocks short as part of its investment strategy. These legal documents also provide information as to how the managers are compensated. Hedge fund managers are paid an annual management fee, and may be paid a performance fee if they meet a benchmark called the hurdle rate. Most managers have been paid pursuant to the «two and 20» rule — i. They appear to be following the «1. Hedge funds are limited to wealthier investors, who can afford the higher fees and risks associated with hedge fund investing, and institutional investors. Investors invest in hedge funds for varying reasons. Some believe that they can achieve higher-than-average returns, while others seek diversification beyond stocks and bonds. That said, while institutional investors have invested heavily in hedge funds, that has begun to change. Hedge funds offer financial rewards based on among other things the way managers are paid, the types of financial vehicles they can invest in, and the dearth of financial regulation that govern them. First, since hedge fund managers are compensated based on the returns they earn, they are driven to achieve above-market returns.

RECOMMENDATIONS TO BUILD WEALTH

They gave us the following information, which allowed us to make a rough estimate of the typical earnings of hedge fund traders. We also ran this document past several other people in the industry and asked them to point out mistakes.

Read on for the details. In this post, we only explore the question of how much staff in hedge funds earn. Hedge funds trade in financial markets on behalf of clients in exchange for annual fees, and a cut of the profits. The revenue of a hedge fund comes from the fees on the assets it manages. Adding the base fee brings the total revenue to 3. The clients would receive 6. These figures are fairly typical. Many people think typical fees in the industry have shrunk in recent years.

This means their total pay is very volatile. In some funds, the percentage the traders earn also depends on performance, making pay even more volatile. Note there are different compensation structures in different funds and roles e. From the above, we can estimate how much traders earn at each stage. The following is all very rough and could be greatly improved with more data.

The extra information about the industry is based on my own judgements having talked to lots of people who work in finance. Of course, very few people make it to this level. Note that some hedge fund managers make more than these figures suggest because they also invest their own money in the fund.

Much of the above also applies to prop trading. Prop traders trade on behalf of their institution, rather than external clients. They usually exist within small partnerships and banks though new regulation has reduced the amount of prop trading in banks. Often prop traders trade with a smaller amount of money, but make more aggressive bets.

Prop traders typically receive a larger fraction of the returns they make e. This means they end up earning a similar amount per year as hedge fund traders. We also found that the 99th percentile in finance i. Some hedge funds have to disclose their total compensation, which means you can estimate the average compensation per staff member.

Many of these figures include support staff too, so they are underestimates of the trading salaries. This puts them in line with our estimates.

Keep in mind that high-frequency firms generally offer higher pay than hedge funds. Finally, your expected earnings will also be very sensitive to personal fit. If you have a higher than average chance of making it to the top roles, your expected earnings could be many times higher, and vice versa. If you donated half, that would be enough to cover the salaries of about 5 non-profit CEOs or academic researchers, while still having a huge amount left to live on.

You can read more in our guide to earning to. To find out more about the job, read this interview with a hedge fund trader. Read next: what are the highest-paying jobs in America?

Get in touch. Get more research like this in your inbox once a month, including our upcoming career review of hedge fund trading. Search for:. Contents Introduction 1 How do hedge funds make money and how is it shared among the employees? Table of Contents 1 How do hedge funds make money and how is it shared among the employees? We want to help. Want to give a lot to charity? Get in touch Get more research like this in your inbox once a month, including our upcoming career review of hedge fund trading.

Like Tweet Share Email Print. Sincethe DJ CS index has been run on a real time basis, so there should be little survivorship or backfill bias after that point. The HFR index goes further back One could also expect the value-weighted DJ CS index to exhibit milder biased than equally weighted fund indices such as the HFR, so it may not be surprising that the average return of the former index is slightly lower 9.

Measuring hedge fund performance in aggregate is notoriously difficult, due to survivorship and backfill bias, as well as the difficulty of finding all the data.

The fund of fund figure how hedge fund manager makes money of funds which invest in a basket of hedge funds is relatively unlikely to have survivorship or backfill bias, but contains additional fees, so is close to a lower bound.

The other indices are more likely to be biased upwards. We analyze the potential biases in reported hedge fund returns, in particular survivor-ship bias and back fill bias. We then decompose the returns into three components: the systematic market exposure betathe value added by hedge funds alphaand the hedge fund fees costs. We analyze the performance of a universe of about 8, hedge funds from the TASS database from January through December Our results indicate that both survivor-ship and back fill biases are potentially serious problems.

Adjusting for these biases brings the net return from We estimate a pre-fee return of Archived linkretrieved April The pay at top investment banks is generally thought to be similar, though Goldman might be at the higher end. Note that as we cover elsewhere, compensation dramatically fluctuates depending on the business cycle.

A hedge fund begins with the person who serves as the general, or managing, partner of the limited partnership that forms the structure of most hedge funds. This is the person who makes the actual investment choices and decisions for the fund. This individual, sometimes with the assistance of some of the initial investors, seeks out potential investors to persuade them to invest in the fund. Hedge funds do not usually look for individual small investors such as the average person who purchases shares in a mutual nanager, but instead seek out how hedge fund manager makes money with large amounts of investment capital with whom to form a limited partnership. A large part of raising investment funds for a hedge fund depends on the initial performance of the fund fubd. To get the fund started and establish an investing track record, the fund manager usually invests a substantial amount of his or her own money into the fund. If the fund manager performs exceptionally well, showing excellent returns on investment, the fund then begins to attract the attention of large institutional investors who have substantial amounts of capital available to invest. Good performance is also likely to elicit investment of additional capital from initial investors. The keys to raising investment capital for a hedge fund are for the fund manager to be able to find and convince some initial investors of his or her ability to manage the fund profitably, and then proceed to cund just that so the fund attracts additional investors in the future. Hedge fund managers are hampered in their efforts to raise funds by regulations that prevent them from publicly advertising a specific fund. Fund managers often seek publicity by offering specific trading ideas on investment websites. Sometimes fund managers offer «seed investment arrangements» to initial investors. In exchange for a substantial investment in the fund, the investor receives a discount on fund management fees or a partial ownership interest in the fund.

Comments

Post a Comment