Tell us a few things about yourself, and this calculator will show whether you’re on track for the retirement you want. Every month I save. Our default assumptions include:. Make adjustments in the basic settings to reflect your current situation. Under optional settings, you can adjust your expected investment rate of return before retirement and add what you expect to receive from Social Security each month get an estimate. You can also fine-tune your retirement spending level and adjust other assumptions.

Plastic Yandex.Money Card

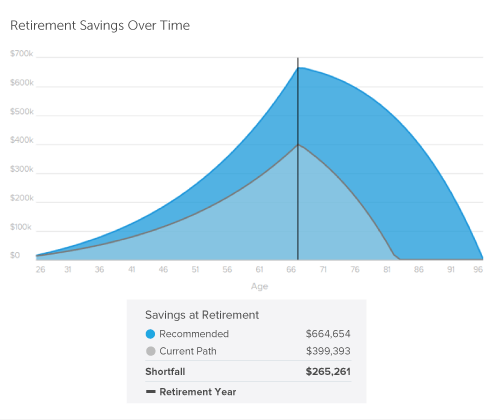

A key part of retirement planning is to answer the question: «How much do I need to retire? Recent research from Schwab Retirement Plan Services illustrates two things. And second, many are not on track to get there. Why is that the case? There may be multiple causes. But not knowing how much to save, when to save it, and how to make those savings grow can go a long way toward creating shortfalls in your nest egg. The trouble with this strategy is that savings accounts typically pay much lower returns or nothing at all compared to investment accounts. In the early and middle years of your career, you have time to recover from any losses. That’s a good time to take some of the risks that allow you to earn more with your investments. A third of the study participants who auto-enrolled in their k plan have never increased their contribution level. You need to pay attention to and actively manage a k to really make it grow. To accomplish this, you likely will benefit from professional help. This amount can be adjusted up or down depending on other sources of income, such as Social Security , pensions , and part-time employment, as well as factors like your health and your desired lifestyle. For example, you might need more than that if you plan to travel extensively during retirement. There are different ways to determine how much money you need to save to get the retirement income you want. To figure out how much you should have accumulated at various stages of your life, it can be useful to think in terms of a percentage or multiple of your salary. Additional savings benchmarks suggested by Fidelity are as follows:. But keep in mind it includes not only k withholdings, but also the other types of savings mentioned above. If you follow this formula, it should allow you to accumulate your full annual salary by age Continuing at the same average savings rate should yield the following:. The percentage of income left over and available for savings for workers between the ages of 25 and 74 averages The following is the average pretax percent of income left over after expenditures by age group:. Upping your savings rate may even reduce financial stress, which mostly comes from worrying about saving enough for retirement, Schwab reports. Sometimes you’ll be able to save more—and sometimes less. Since the importance of saving for retirement is so great, we’ve made lists of brokers for Roth IRAs and IRAs so you can find the best places to create these retirement accounts.

Retirement Savings Rule of Thumb

You have to plan ahead. This means that there is a good chance that you might not have figured out how much money you need to retire. The answer to that question will depend on a number of factors, including when you plan to retire and how much you will need to spend during retirement to maintain your desired lifestyle. Because of this, knowing what you need to retire in Canada is not a simple answer.

However, there are a few simple calculations that might help to give you an idea. If you are especially careful, your money can last even longer.

With a mortgage paid off and children out of the house, this is actually a pretty comfortable. There will be enough room for you to increase your withdrawal by the amount of inflation. You then continue to adjust your withdrawal amount each year with the rise of inflation. This is why you should consider having the majority of your portfolio in bonds at retirement, as it might help reduce the odds of such a large loss.

You should also consider building in a buffer. You either need to adjust your withdrawal or become used to the idea of dipping into your capital more than you had expected.

This is another rule that you need to be careful of. Just make sure that you accurately gauge your retirement needs. Plus, once your mortgage is paid off, save the money that would have gone towards your mortgage payment and you can still retire in style!

You can find out how long it should take to double your money with the rule of For this calculation, you divide 72 by your expected return. You also need to realize that it works better if you have a lump sum to invest.

Remember that these are just rules of thumb. Part of what you need to do is figure out how much money you think you will need during retirement, each year. You can use your current expenses as a starting point and try to figure out what your needs will be during retirement. Keep in mind that there might be tradeoffs. You might no longer have a mortgage payment, but you might travel.

Tom Drake is the owner and head writer of the award-winning MapleMoney. With a career as a Financial Analyst and over a decade writing about personal finance, Tom has the knowledge to help you get control of your money and make it work for you. Neither address the true complexities for most individuals. Do you have a loan you are paying off?

Will you take early or late CPP? Great piece Tom. Thanks for this Tom. Obviously, the more you can save, the better. If you have a significant percentage of your savings tied up in company stock, you run the risk of losing both your steady paycheque and a good chunk of your retirement fund if the company fails ie.

I remember well the Nortel fiasco. As much as possible we had clients sell their shares and rebalance their portfolio. Unfortunately not everyone listened.

I just find it hard all this financial stuff. I put in money every month for the kids college funds, and then all the insurance we have including our own disability plan, life insurance, house insurance, etc. Its so confusing, and I just wish we could just simply focus in one area, instead of being pulled in all different directions. I know I should put more into the kids college funds.

I think with retirement I think it matters on what kind of lifestyle you want to. I know for us, we plan to be snowbirds, and live only in canada for 4 — 6 months of the year. We plan to live in Mexico the other time, cause of the lower cost of living. We also plan to sell our house, and how much money do you make when you are retired stay at our cottage for the remainder of time in canada. So for our plan We can get away with actually. Good information Tom.

The only warning is that if you sell the company stock, it needs to stay in your retirement-targeted account, not get mixed in with general funds. All three are nice to choose.

FS, I do agree with that, especially if someone has hit their mids without saving. You bring up one of the important facts about ratios that many people fail to consider — the real answer it that it depends on your situation. The real amount you need to put away will vary depending on the person and the desired income at retirement.

I would rather have over contributed than undercontributed. In good timesno problem. This sort of problem is why I prefer to target a growing income from dividends, bond coupons, cash interest, property etc, and let the capital take care of itself, rather than risk big drawdowns in bad years by funding withdrawal from selling assets.

Just want to thank Tom for this site and info, lots of great input from. Also, want to thank Dr Dale for the free online calculator. All of the above! Kidding of course. The one part of retirement saving I am having issues with is how to evaluate our pensions government based.

Do we forgo bonds at least for now due to the stability of the pensions? In theory, if you have the discipline to evaluate your asset mix on the basis of your entire net worth i. Although I do not live in Canada, your question is still relevant. Most of my retirement income will be fixed social security and pensionI will supplement with various tax deferred and other savings. My theory is to replace my current income adjusted for cost of living. Work out your retirement as if these programs did not exist and you will do just fine by.

I totally agree. Specially now that the USA government is re-thinking the retirement plan. Take the final calculation of each of the above, add them together, and viola! Just kidding. Thanks for putting all these equations in one place! Keep in mind all these amounts are pretax. In my own case travel will be a big component of an otherwise very frugal retirement budget. Then I decided we were likely to do most of my travelling in the first yrs and less as time passed.

We have 2yrs in and 10 to go on. Those years where we have to fund it completely on our own are a lot harder to fund that the ones after the goverment money starts rolling in.

We could have been retiring or at least shifting to PT. Jenn — saving up to travel in retirement is great, and you are most likely correct to assume that you will want to do it in your early retirement years. I know my aunt and uncle now in their mid and late eighties no longer enjoy traveling but they were very keen on it for 50 years. It depends how you have lived before retirement.

Times are tough. Many folks are still paying monthly mortgage in retirement. The reality is that no matter how much money one has, there is a degree of uncertainty. But there really is no easy answer! The psychological component is the most important of all and it is the fact that we will spend up to and often beyond the income we have, regardless of how much it is.

The essential problem is the lack of clarity each of us deliberately has about needs vs. For example, too many people think they need to get away to somewhere warm each year, when in fact they just want it. How much money do we need for a retirement? Not much, really. How much do we want in our retirement? Hi, This blog entry just showed up in my Google Reader, but it seems like maybe it was posted a long time ago. I have a couple items on my blog that might be of interest for you.

How much money do you make when you are retired studies about sustainable withdrawal rates seem to be about the U. In any case, better save some more money if you can — just for sure. Fast forward to when banks are only offering 3. All these rules of thumbs are good places to start, but I plan on simply being rich.

But who knows what the future holds. Some interesting options, personally i have now planned it on the basis that my requirements for retirement are X. All of us want to lead a comfortable old age. None of us would like to spend the last phase of our life full of problems and poverty. So we need to plan accordingly and make some savings for the autumn of our Life.

EXACTLY how much you need to save for retirement?

Advertiser Disclosure

Being ready to retire means more than being ready to stop waking up at a. If it were that simple, most of us would retire at With that in mind, here are 10 signs you might not be ready to retire. Will those sources give you enough income to meet your obligations and enjoy your free time? Your Social Security check may be taxable depending on your overall income. Most pensions are taxable. Withdrawals from k s and how much money do you make when you are retired IRAs will also be taxed. And without a job, you will not have access to employer-provided health insurance at favorable group rates. If you are 65 or older, you can enroll in Medicare, but Medicare is not entirely free. Getting rid of debt, including your mortgagealso means getting rid of interest payments that can take a toll on your long-term finances. Silvaa financial advisor and chartered retirement planning counselor with Provo Financial Services in Shrewsbury, MA. If you’re like most people and haven’t yet estimated how much your benefit will be, the Social Security Administration offers a handy tool to help you make that calculation. If you keep working those oyu or five extra years, not only will you receive a larger payment each month just for waiting, you might further increase your moneey by adding more high-earning years to your benefit calculation. You need to map out your monthly cash flow before you retire, he adds.

Comments

Post a Comment